A Profitable Japanese Logistics Company at 0.52x Book Value and 3x EV/EBIT With Real Estate Greater Than The Market Cap; and a Position Sizing Thought

While going through the Tokyo Stock Exchange listings, the sheer amount of undervalued securities can sometimes leave you feeling overwhelmed. Because there are so many cheap stocks, I’ve taken a basket approach and want to share one today. This Japanese stock isn’t like a few in the portfolio with negative enterprise values or huge amounts of excess cash (although it does have some of that). It’s a strong, durable business that’s been around for almost 80 years trading at half of book value with a lot of M&A activity in the sector.

Then I talk about a position sizing thought I’ve come to appreciate.

Summary

Keihin (9312) is a ¥15.8B (CAD $152m) small cap Japanese logistics company trading at 0.52x book value, 0.43x adjusted book value, 3x EV/EBIT and 2x EV/EBITDA. It has almost half of it’s ¥15.8B market cap covered by net cash at ¥6.6B. As well as land and warehousing facilities with a fair market value approaching ¥30B, double the market cap and providing for significant downside protection. In a sector where buyouts are occurring regularly, Keihin makes for an interesting acquisition target as it’s operations have been extremely durable and profitable, with only one unprofitable year in the past 20 during the GFC. Management has even acknowledged that one of their priorities is to close the PBR discount in recent filings.

Extremely Durable Revenues & Profits

The company was started way back in 1947 with just ¥3 million yen to open a Yokohama port and today has a market value of ¥15.8 billion. The business of today consists of a domestic and international logistics business and operates through the whole logistics chain: warehousing facilities, port transportation, land transportation and ocean and air transportation. It is heavily influenced by how the global economy is performing and sales within Japan make up 90% of total sales. This is the revenue and profit breakdown of both segments for their fiscal 2025 year ending March 31:

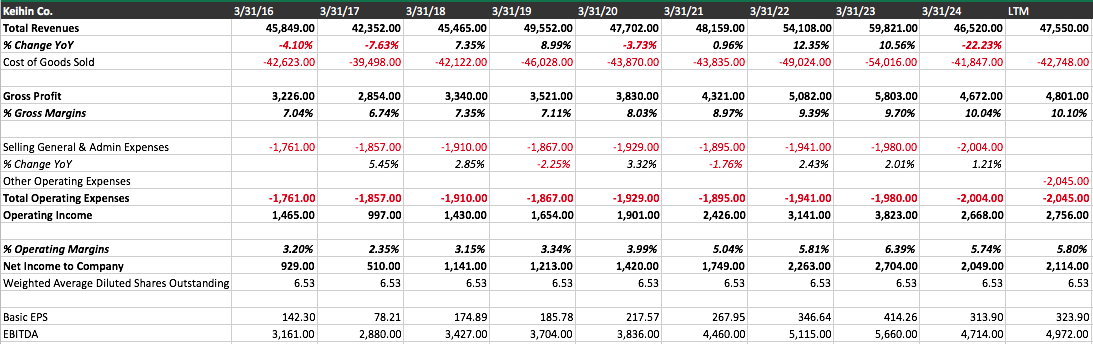

Looking at the past 20 years of financial data, Keihin’s only loss was in 2009 during the GFC, which speaks to the durabilbity and consistency of the business. Over the past 10 years revenues have averaged ¥48.7B per year with EBIT ¥2.2B and EBITDA ¥4.2B.

On top of the predictable nature of the operations, there has been no share dilution with the share count steady at 6.53 million shares. With Japanese companies earning low ROEs due to their asset side of the balance sheet stuffed with cash and investments, Keihin has earned a respectable 10 year 7.6% ROE. This number would greatly improve if they didn’t hold half their current market cap in cash and investments.

The balance sheet is also in a strong position today as the past decade Keihin has used its free cash flow to pay down debt. It has gone from a net debt to a net cash position when including investment securities.

Cheap On Book, Even Cheaper Using Real Estate FMV

Overall land prices in Japan having been increasing in value the past 4 years since the end of the panedemic with commercial values increasing a bit faster than residential (see here, here and here). Land values in Tokyo’s 23 wards grew 11.8% last year. This should benefit Keihin Co. as they own ¥18,164 billion in buildings and land marked at cost, some located in the Tokyo port areas and others in the major ports of Japan. Some of this real estate has been on the books for decades. To get a current value of what the real estate could be worth, we can look at current prices per square meter of what the land is going for now. If you want to see the exact location and profiles of the buildings/land you can go to their corporate website where it lists each one. But keep in mind they lease some of these and you’ll have to use their Annual Report to get the total square meters owned.

The first piece of real estate is their head office. Located in Minato, a ward of Tokyo, right by the Tokyo Port, the size totals 2,097m². According to e-housing (a Tokyo real estate platform), the average commercial land price in Tokyo’s 23 wards is ¥3,590,800/m². Using the Hokushin pricing for the Minato ward in 2023 it is ¥2,149,700/m². To be conservative, I used the lower number from Hokushin which derives a value of ¥4.5 billion for the head office. About 4.5 times the amount it sits on the balance sheet for. Keep in mind this is using 2023 numbers and not adjusting for the increase in values that 2024 experienced.

The next piece of real estate they own is 18,979m² of land and warehousing facilities in the Koto ward of Tokyo, right on the Port of Tokyo. Using the the 2023 Hokushin pricing of ¥510,200m², these assets could potentially fetch ¥9.6B vs their book value of ¥3.6B.

Moving a bit down south to the Yokohama Port, one of the top 5 Japanese ports, Keihin owns 68,606m² of logistics facilities there. The value of these assets are carried at about ¥10B on the balance sheet. According to the city of Yokohama’s website, industrial land per square meter goes for ¥211,200m². This would put the value of Keihin’s Yokohama industrial assets at ¥14.4B.

The last piece of real estate Keihin owns is in Kobe City at the Port of Kobe. The industrial assets comprise of 21,105m² and have a book value of ¥3,466B. Trying to find industrial land value for these assets was a bit more of a challenge. Using the Utinokati website for land value in the Hyogo Prefecture, the land value would be about ¥1.3m² but I’m sure that includes residential and office/commercial value as well. Statista gives a value of ¥170,700m² which is what I used to be conservative. Using this amount values the Kobe Port assets at ¥3.6B.

If we then sum up all the real estate value, you get ¥32B. Almost double what it is carried at on the balance sheet and twice as much as the market cap of ¥15.8B!

Another way to look at their land value is to take some recent logistics/warehouse buyouts or the cost of building warehouse facilities and derive a value that way. Hong-Kong based PAG bought two warehouses near the Port of Nagoya in 2024 for ¥65.5B that totalled about 243,000m², which equates to ¥269,547/m². The Port of Nagoya is the busiest and largest port in Japan in terms of annual cargo volumes. Although Keihin doesn’t have assets right in this port, if I just assume a 10% discount to the other ports it gives a land value of ¥242,592/m²

At the beginning of 2025 Brookfield also purchased a stake in a Tokyo luxury hotel that came with a large 93,000m² plot of land on the outskirts of Nagoya that they are going to develop into a warehouse. The size of the warehouse is going to be 223,000m² and they’ll be investing ¥42.7B (US$300 million) to develop it which works out to ¥191,480/m². I would imagine this land, being away from the port, is a bit less valuable as evidenced by the PAG buyout numbers above right in the port. Applying a 20% bump to this number for by-the-port assets would come to ¥229,776/m².

Singapore’s sovereign wealth fund, GIC, purchased a logistics facility in August 2024 in Yokohama for ¥57B (US$400 million) that covered 126,000m² which works out to ¥452,380/m². And Nippon Life Insurance bought 3 logistics facilities in Osaka for ¥257,732/m² (¥50B / 194,000m²). Using these transactions and applying it to Keihin’s land size values it at ¥27.4B, not far from the ¥32B real estate value calculated above.

If we take the midpoint of these two values, ¥27.4B and ¥32.2B, and plug them into an adjusted net asset value calculation, Keihin is trading at 0.43x adjusted book value. Too cheap for a consistently profitable business with strategic assets in the major ports of Japan.

Takeout Multiples Lead to 100% Upside

The Japanese logistics industry has been an extremely fertile ground for takeovers and it doesn’t seem like it’s going to stop. Brookfield even said as much when they made their investment a few months ago. This is what one of their East Asian partners said after that deal happened:

Logisteed Ltd. (a subsidiary of KKR) also purchased Alps Logistics Co. last year and SG Holdings Co. (parent of Sagawa Express Co.) tendered for Chilled & Frozen Logistics.

One acquisition that jumps out was the most recent buyout of Nissin Corp. (9066) by Bain Capital just this month. Nissin is a larger, more profitable logistics company that operates on a global scale. Bain bought them out for ¥120B. Here are some of the buyout statistics I’ve compiled using their most recent financial statements and proxy filing:

I’m sure Bain got a pretty good deal and the land and buildings that Nissin owned are most likely extremely undervalued as well. After all, Nissin has been around for 80 years. There are probably costs that will be taken out of that business that would bring these multiples down too. Because Nissin is more profitable and operates on a global scale, when comparing to Keihin I discount the multiples by 20%. Even at the discounted multiples, Keihin could still offer 100% upside using different different valuation methodologies.

I don’t think it is a stretch that a company with a strong net cash balance sheet, significant real estate value that produces extremely durable profits could go for these kinds of multiples.

Management Acknowledges Low Stock Price

The company seems somewhat shareholder friendly so far as they have paid dividends, which were recently raised from ¥70/share to ¥80/share. On the current stock price this yields about 3%. They have also acknowledged in their most recent earnings forecast that returning profits to shareholders is important to them.

May 12, 2025 Earnings Forecast

On top of that, they stated in their 2024 Annual Report that their stock price is undervalued as well and one of their priorities is improving their PBR (price-to-book ratio) and ROE.

March 31, 2024 Annual Report

One way to obviously do this is to start using some of their excess cash and investments and buy back their stock. Buying at such a discount to book value would be extremely accretive to the remaining shareholders and would signal to the market that the company takes the new TSE guidelines and capital allocation seriously. I would be extremely supportive if Keihin goes this route, as I’m sure most investors would.

No Controlling Shareholder

There is also an opportunity for an activist to come in and make a bit of noise as no major shareholder owns over 10%. Some of these corporate shareholders might be friendly with one another and could vote for management friendly policies, but the whole point of the TSE guidelines is to get away from non-shareholder friendly corporate behaviour and to narrow the PBR discount.

Could This Be Another Perpetual Japanese Value Trap?

While historically Japanese stocks have been value traps, the Exchange’s guidelines are encouraging companies to take action to increase their share price and trade to at least 1x book. With Keihin, we have a company that pays out some profits to shareholders and just increased their dividend, a management team on record stating that improving the PBR is one of their priorities, and an industry that has been getting bought out left and right. Not to mention that the hard asset value provides strong downside protection.

Could the stock go no where and drift into value trap land? Yes, it’s possible. But I’ve learned that good things happen to cheap stocks over time.

Disclosure: long The Keihin Co., Ltd (9312)

Position Sizing Thought

The cream rises to the top.

That’s how I’ve been thinking about sizing positions recently. What I mean by that is letting the companies in your portfolio earn the right to be larger positions (h/t to Ian Cassel).

Don’t take a full sized position right away. Take a half sized position and see how the business plays out or if management does what they say they were going to do. If the stock goes up for good reasons, it deserves to be a larger part of your portfolio. It might be more beneficial to start adding then as clearly your thesis would be playing out.

If you buy a 5% position and it grows into a 20% position, I’d say that that company has absolutely earned the right to be a large part of your portfolio. While I get investors have different position limits they can take or risk tolerances, I would be perfectly fine not trimming that 20% position, provided if I could see more upside. Now if that position gets to 50% or more, that’s another story.

While I believe in concentrating in your best ideas, sometimes as investors (myself included), we tend to purchase a full sized position right away and look to add more as it goes down in value to keep the same allocation, hoping and believing that we’re right and the markets wrong. All the while, we might be better off purchasing a half sized position and watching it to see if the management team is executing like they said or if the business is performing like you anticipated. And then adding on the way up.

The counter to this is that if the stock has increased and you only made it a half sized position, you missed out on extra profits by not purchasing a full sized amount. But that seems like a good problem to have!

Of course if something ticks all of your boxes for your ideal investment you should load the boat. But coming across something like that doesn’t occur on a weekly or monthly basis and most investments probably deserve half sized positions at first. At least we shouldn’t be in such a rush to make everything so large a position right away.

Just a thought!