An Expert Market Security at 3x FCF Buying Back Tons of Stock

Note: this is an extremely illiquid security and doesn’t trade a lot on the OTC expert market. If interested, I wouldn’t rush into purchasing as small amounts of volume can move the stock. I still haven’t received 2024 financials but used the tendering document that disclosed unaudited 2024 financials and used 2023 financials for some segment data. Once I receive the audited 2024 financials I will update this. This is not investment advice.

Western Capital Resources Inc. (WCRS) is a bit of a quirky security. It trades at:

3x EV/FCF

It’s net cash makes up 50% of it’s market cap

They’ve repurchased 42% of it’s shares in the past 2 years

It has a variety of small niche businesses that spit off cash.

If you go online to crack open the most recent annual report you won’t find it. Because with some OTC stocks that go dark this company no longer files with the SEC as of July 2022. You have to be a shareholder to obtain their financial info.

If you dig a little online you can read that they recently did a tender offer and inside that tender offer document they list how many shares they were offering to buy, but it also had their financial statements included the past few years that have only been available to shareholders. Reading this document sent me down a bit of a rabbit hole.

There’s an accounting quirk in their financial statements that skews their true outstanding share count and when taking this number into account you’ll see that what’s on the reported financial statements as shares outstanding is “technically” not true.

Capitalization

They’re current capitalization seems pretty straightforward. I’ve got it at roughly 5x trailing EV/EBITDA and 7x trailing FCF before making any adjustments. It’s cheap but not egregiously cheap from an initial look. Using 8.1m shares outstanding and a $13 stock price, the market cap is $105m today. Adding $13m in debt, a small noncontrolling interest of $1.4m and netting out the $48m in cash, the total enterprise value is $72m.

What’s the Company Do?

Western Capital was spun off in 2006 from Multiband Corporation as a Minnessota incorporated company but was called URON back then. Not until 2008 did they change their name to the current one. In 2012, Blackstreet Capital Management became the majority shareholder using various partnerships (like WCR LLC) and are still the largest shareholder to this day. Blackstreet is a holding company that owns various businesses either in distress, underperforming or are in out of favour industries. It was formed by Murry Gunty in 2002 who is also the CEO of Black Bear Sports Group, which owns 42 ice rinks in some eastern States. The few LLCs that own Western Capital are just cash and Western Capital stock.

In 2016 Western Capital redomiciled to become a Delaware corporation. They went dark in the summer of 2022 to “reduce or eliminate significant compliance costs associated with the Company’s public reporting status”.

This company is a cash flowing machine with a few odds and ends businesses. They operate cellular retail stores, pay day loan centres, ice rinks and some other segments. I wouldn’t say these businesses are great but they are niche, stable and cash flowing. They are focused on making acquisitions of strong cash flow generating businesses or buying assets that need a bit of fixing.

Over the past 5 years the’ve grown revenues from $130m to $189m and have produced free cash flow each year, even during covid. Since I haven’t received the 2024 financials that disclose each segment numbers, I’m basing the size of the overall segment on 2023 ending numbers. They operate the following segments:

Segment #1 - Cellular Retail Segment

This is their largest and most profitable segment and represented 62% 2023 revenue and 57% of 2023 net income. They operate authorized Cricket Wireless dealers which means they can only sell and operate customers on the Cricket network. They’ve bought dealer stores over the years and currently have approximately 259 cellular retail stores (119 100% owned and 140 less than 100% owned, which is what the minority interest distributions go to on the income statement). They charge customers based on a no-contract basis which is a pay as you go phone plan vs signing up customers to long-term phone contracts and collecting monthly fees. They also sell cell phones and accessories in the store. Profits have grown as they’ve acquired stores. Cricket is owned by AT&T and they have just over 4,000 locations in total across the US so Western owns about 6% of the total stores.

Segment # 2 - Direct to Consumer

This segment sells a variety of garden products under different brands like Jackson & Perkins which is 150 years old, Park Seed or Wayside Gardens. It’s their second largest segment and did $43m of 2023 revenues (25%) and $4.1m in net income (32%). You can go to their website and order plants, seeds, gardening supplies and home restoration furniture. Because there is no retail footprint, the costs of running this business are lower than the typical B&M businesses. It’s usually seasonal as most garden companies have little sales occurring in the summer months.

Northern Brewer was purchased in July 2024 for $6.2m and was added to this segment. Northern is another online retailer that sells home-brewing beer and wine-making kits and equipment. The results for all of Western in 2024 were weighed down by Northern as they reported a $2.2m loss. They recently moved the distribution operations from Minnesota to South Carolina as this reddit post notes. I would assume moving the facilities to combine it with the plant operations would help save money as they’ll save on duplicative fulfillment costs going forward.

Segment #3 - Consumer Finance

Their third largest segment operates 19 payday loan centers and 3 pawn store locations. It did $7.1m of revenue in 2023 (4% total) and only $846K of net income (less than 1% overall). These stores provide high interest “payday loans” and other short term forms of financing to weak credit borrowers. The loan size is typically a few hundred dollars and lasts up to a month.

While not my favourite business given the highly regulated nature (there is always the threat of Congress waving their pen and abolishing or dismantling the entire industry) and low barriers to actually opening up a payday loan business, it does serve some need as there are consumers that are shut out of the traditional banking system because of their credit scores and need some place for quick cash.

It doesn’t tie up a ton of capital as the payback period on the loans are very fast which leads to lower loans receivable balances outstanding. However, there will always be a problem with collecting 100% of the amount lent out.

There largest geographic exporsure in this segment is North Dakota, Iowa, Kansas and Wyoming. Nebraska used to be in the top 4 but they ceased writing new loans in 2020 because the people of Nebraska passed an initiative that limits the annual interest rate on payday lenders to 36%. There are now 20 states (plus DC) that have capped rates payday lenders can charge consumers, up from 16 states 10 years ago. That’ll always be a risk to this line of business as more and more states have voted to cap the rates.

Segment # 4 - Manufacturing

This division was added in 2021 when they purchased Swisher for about $3.5m. It had revenue of $10.4m in 2023 (6%) and barely any net income. The Swisher brand manufactures an assortment of outdoor products like mowers, log splitters and other timber items, safety shelters and other products. A big competitor in the space as you’d imagine is Deere.

Segment #5 - Ice Rinks

After going dark, they entered into a new segment and purchased 6 ice rinks (including the real estate) in the state of Michigan and New York. Murry was on a podcast last year and gives a good background on how he got into purchasing arenas for Black Bear and the business behind them and I imagine it’s why Western has started buying them. He makes an interesting point that the ice rink arena business model has a different customer and consumer where the customer is the parent and the consumer is the child. Both have to have a good experience for the arena to be successful.

If your buying an ice rink, you can make money a few ways: renting the ice out at a certain rate to the general public, running hockey leagues and the concession. From what I could find online there are about 2,600 ice rinks in the US: 2,100 indoor and 500 outdoor. If a municipality runs the rink it usually does at a loss which has given the private sector a chance to come in and take over some arenas.

There’s actually a publicly traded company in Canada, Canlan Ice Sports Corp., that runs 15 arena facilities mainly in Canada and some in Illinois as well that would be a decent comp. In 2024 it did $94m in revenue and $3m in earnings which shows that these arenas can be run at a decent profit.

Those are the 5 lines of businesses that Western is currently in. But the thing that really interested me was located in the cash flow statement.

Cash Flow Statement Quirk

Below is Western’s 2021 financing section of it’s cash flow statement. Looks pretty normal.

Compare it to their 2023/2022 cash flow statement after going dark.

That “Purchases of contra equity” jumps right out. What does that mean? Reading a bit further down after these financials, you somewhat get your answer.

“Purchases of contra equity”. Other wise known as treasury stock, which is a contra equity account. By buying back your own shares, you are reducing your equity balance (which should be in a credit balance if the company has retained earnings i.e. contra equity is a debit that reduces equity). But Western Capital isn’t exactly buying back their own stock. They are buying the LLC’s interests that have stakes in the company. So they are indirectly buying back the shares. And they plan on cancelling these shares as well.

So technically on the tender document they can say their current shares outstanding is 8.8m as of March 20, 2025. But if you consider all the contra equity purchases and actual stock buybacks since going dark, they’ve bought back 3.8m shares. Meaning they’ve bought back 42% of their shares over the past 3 years!

Right now the stock is even trading below their most recent tender of $15/share too that was just done in April.

Why’s it Cheap?

I’m sure you can come up with a few reasons why it’s so cheap but I’ll go ahead and state some of them.

It trades on the OTC Expert Market because they don’t report their numbers with the SEC as of 2022. You have to be a shareholder to actually get their financials.

Because of the SEC rule change a few years ago, most investment brokers don’t let investors purchase certain OTC stocks, they only allow you to sell them if you had them in your account. So it can be tough to buy these. Anytime it’s difficult to buy a security, the probability of it being mispriced increases.

This stock barely trades. You’d be lucky on a good day if it has any volume.

It also has an extremely large shareholder that owns its stake through various LLCs.

Normalizing 2024

At first glance, 2024’s numbers don’t look as good as in prior years. But there are certain adjustments that should be made to come to a normalized earnings figure. With the purchase of Northern Brewer last year, their loss of $2.2m dollars was included. They took a $0.7m goodwill charge and there was also a transaction/integration charge related to this acquisition of $1m. Adding back these one offs and the FCF for 2024 comes to just over 12m. If they can turn a profit at Northern Brewer, these numbers would increase.

Valuing Western Capital

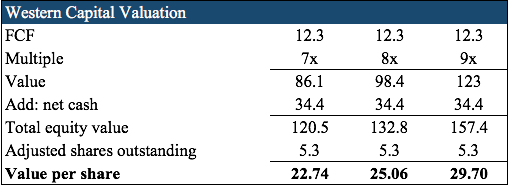

Right now, without making any number adjustments, Western’s trading at 7x trailing FCF. But if you make the one time expense adjustments and assume they can cut the small loss at Northern Brewer (without actually adding anything into profits), it’s trading at 3x EV/FCF. The business’ cash flows are pretty stable so I’m comfortable forecasting the same amount of FCF for 2025. What’s the right multiple on these diverse stream of cash flows? I don’t know exactly but 3x feels way too low. If we use the current face multiple of 7x that it’s trading at and add the net cash, upside is about $23. Using some higher multiples will obviously increase the price some more. My range of fair value is anywhere from $23 - $30 for upside of 77% - 131%. These numbers would increase if they continue to buy back their own shares at their current rate.

I didn’t do a segment multiple analysis on each business line as the price today is crazy cheap. Once/if the stock price increases, then I’ll try to get a bit more granular but the margin of safety here is already quite large and with net cash making up 50% of market cap and the company turning into a share cannibal, the downside to me seems limited here.

Risks

With all OTC stocks, each one comes with more than your standard risk. One major one here is that Black Street, the largest investor, sold Northern Brewer to Western which is obviously a non-arms length transaction. This could give the impression that Black Street wanted to offload this loss making business to cash out and used Western to do so. But there was a fairness opinion done and I believe there is strategic business sense for Western to own that asset as opposed to Black Street.

Another risk, which ties into the first one, is that Black Street owns a majority stake in Western. While I don’t have updated figures as of today, their last 13D before they went dark showed they owned 75% of the shares. The buybacks since have been for some of those shares and if they didn’t sell into the tender or any buybacks that occurred last year, I peg them still at 75%. If they did sell some into the tender, I’ll find out once I receive some of their most recent documents. So what Black Street says essentially goes here. Being domiciled in Delaware certainly helps protect shareholders if some type of bad governance were to occur. But buying back extremely undervalued stock is the exact opposite of bad governance. If Black Street or anyone else tried to buyout the remaining shareholders for way less than fair value, being incorporated in Delaware should help protect minority shareholders.

If Congress were to eliminate high APR’s that payloan centres can charge, it would affect Western’s Consumer Finance segment. Because this segment doesn’t contribute that much to profits (<1%), the effect would be muted and isn’t that large of a risk to worry about in my opinion.

Summary

This is an illiquid, undervalued OTC expert market security that trades at 3x EV/FCF, has repurchased 42% of its shares in the past few years that offers an estimated 77%-131% upside to fair value.

Disclosure: Long WCSR