New Idea: Beng Kuang Marine Ltd.

Summary

Beng Kuang Marine Limited (BEZ.SI) has undergone a complete business transformation over the past few years brought about from the CEO hired in 2021. What was once an over indebted loss making company that operated in the shipping/oil and gas sector has monetized under-utilized assets, cut costs, paid down debt and entered into business lines that offer predictable recurring contracts. All of this has led to a business that has compounded revenues at 22% over the last 5 years and has allowed BEZ to turn a sustainable profit. Based on todays stock price and the markets uncertainty of a slow down in the business this year, I believe you can purchase BEZ at 3x FCF with a strong net cash balance sheet and an investment property that provides downside protection.

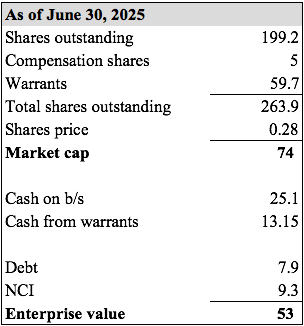

Capital Structure

Why’s it cheap?

Consistent losses. Up until recently their last profitable year was back in 2016 and they’ve had to take impairment charges over time on some of their assets due to the unpredictable nature of their former shipping segment.

Tied to the price of oil. Their business services the oil industry and if the oil price is down there’s less work for them to do on the vessels they work on as there will be less maintenance.

Trades on a foreign stock exchange. It trades on the Singapore Exchange and not many people are likely looking at a small cap Singapore company that operates ancillary to the oil industry.

Warrant overhang. BEZ issued a ton of warrants in September 2024 (30% of total shares outstanding at the time) at $0.22/share and are currently in the money that could be weighing on the stock.

Recent sales decline has the market worried. The stock has come off from it’s high of $.37/share as the market is unsure if the current revenue decline this year will continue going forward.

History

BEZ was founded in 1994 and has been listed on the Mainboard of the Singapore Exchange since 2004. Up until recently, it’s assets consisted of two warehouses, a shipping yard in Batam and a couple of vessels. Historically, it operated 4 divisions: Corrosion Prevention, Infrastructure Engineering, Supply & Distribution and Shipping. The shipping business consisted of some tug boats and as you would expect was not a very good business. The volatility in charter rates resulted in the shipping segment causing large losses in the consolidated financials.

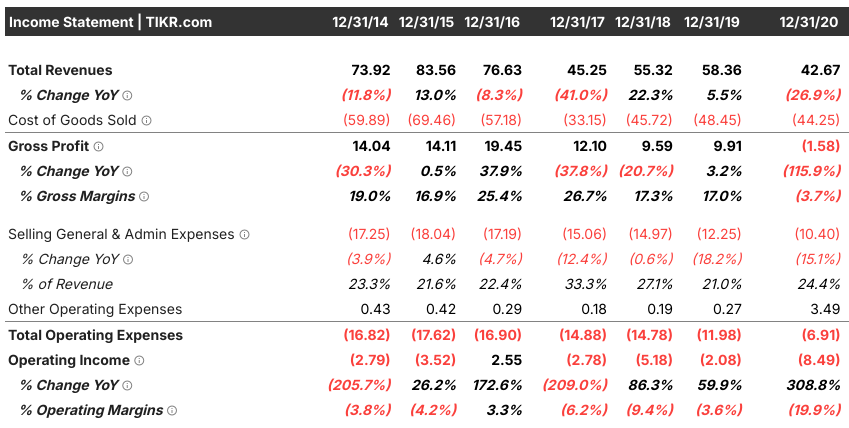

Looking at the income statement below, you can see revenues stagnant to declining from 2014 - 2020 and the company earning an operating profit in only one of those years.

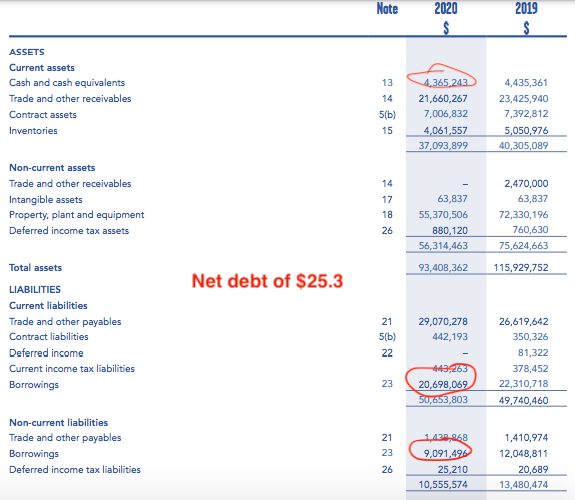

With the company losing money pretty consistently year after year, it had a large effect on the balance sheet. Going into COVID, BEZ had net debt of S$25.3m and PP&E made up nearly 60% of total assets. From a liquidity perspective, they weren’t in a good position as current liabilities were greater than their current assets.

It’s generally not a good idea to be over levered in a cyclical industry where you can’t maintain profitability. Any hiccup in the business can send you to bankruptcy.

BKM 2.0

In 2021, Beng hired Yong Jiunn Run as their new CEO. Yong spent his whole career in banking and was the former head of commercial banking of CIMB Singapore before he was let go during COVD. Upon taking the CEO job, he lent S$500,000 to the company in order to keep it going and initiated a strategic review. This strategic review was known as BKM 2.0 and it prioritized cutting costs, deleveraging, shutting down or winding down unprofitable business segments and pivoting toward a more asset lite/service oriented business model.

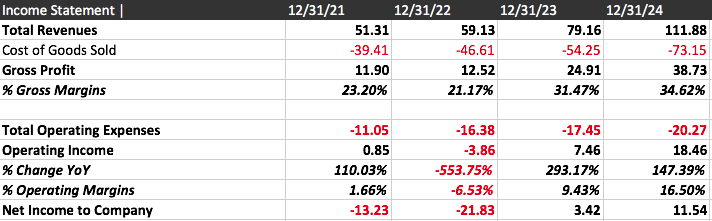

Over the past 4 years, the plan has been put into great affect. Going from a large net debt balance sheet with consistent operating losses to growing revenues quickly and expanding margins to finally turning a profit. Here’s just a few of the highlights:

Sold 2/3rd of their 32.8 hectares waterfront yard in Batam for S$19 million

Wound down the unprofitable shipping division and sold one of the tugboats for S$1 million

Gross margin has gone from low 20% to mid 30%

From the end of 2021 to the most recent released June 2025 balance sheet, debt has gone from $25.2m to $7.9m and cash has gone from $7m to $25m. That’s a net cash swing of $35.3m and net cash now sits at $17.1m.

PP&E is now 15% of total assets, showing the less capital intensive nature of their current operations.

The stock price has responded extremely well to these results, going from $0.03 - $0.04/share to where it sits now at $0.28/share.

Makeup of Beng Kuang Marine Today

Presently, BEZ is made up of two segments: their Infrastructure Engineering (“IE”) and Corrosive Prevention (“CP”) segment. Their IE segment offers a range of services to offshore vessels (FPSOs and FSOs) like maintaining and servicing the vessels, supplying customized deck cranes, life extension and conversion projects. Because these vessels are in harsh water environments, there is more wear and tear and therefore maintenance is required to ensure safety standards are maintained. They’ve gotten out of performing longer-term contracts that are more susceptible to delays and cancellations and focused on shorter-term contracts that turn over quicker but have predictable margins and offer greater stability.

The gem of this segment is their 51% owned subsidiary Asian Sealand Offshore and Marine Pte Ltd (“ASOM”) that has been growing revenues and operating profits exponentially over the past 5 years. It focuses on optimizing and extending the life of these floating assets. This is what has been BEZ’s largest contributor to the overall growth recently. It’s owned in their IE segment and makes up pretty much all of their current revenues and profits. From 2020 to 2024 revenues have gone up 10x and pre-tax income 14x.

ASOM has been expanding their services to FPSOs all over the world from China, West Africa and South America which has caused this dramatic reverse in fortunes. As of last year, they serviced 24 of 186 FPSOs globally as they’ve expanded, which has allowed them to take market share. According to the CEO, once an FPSO uses your company, they will continue to seek your service because you understand what works and what doesn’t for that particular FPSO creating a sticky customer relationship. If you operate an FPSO/FSO, you don’t want to risk downtime by choosing a company who has no experience with your particular vessel.

Their CP segment provides an essential service in extending the life of vessels by removing corrosion. BEZ is the “Resident Contractor” in several shipyards in Singapore and Batam, Indonesia. It cleans the hull of the ships, removes any type of marine growth and applies protective paint to the hull to help shield it from further corrosion. This division has been around for 30 years and the revenues are largely recurring

Industry

The offshore oil and gas industry are serviced by both FPSO’s (Floating, Production, Storage and Offloading) and FSO’s (Floating, storage and offloading) usually in deep or ultra deepwater fields. FPSO’s and FSO’s hold the oil drilled up from the sea reservoirs with the primary difference being that FPSO’s can separate the hydrocarbons on board into their different components (oil, gas, water) and FSO’s just store the crude oil without being able to process it until a tanker comes and takes it off their hands. The reason these vessels of the offshore industry exist is because the typical pipelines attached to onshore oil and gas sites can’t be replicated offshore due to the huge cost burden it would take or it physically can’t be done as a result of technical challenges.

Right now there are roughly 180 FPSOs in operation all over the world and according to data put out a couple of years ago, more than half of the FPSOs are over 30 years old and a quarter are over 40 years old so there is clearly huge continuous demand for servicing these vessels and keeping them in service. However, the two key drivers of the industry right now that make an investment in BEZ potentially more interesting are 1) more and more oil discoveries are occurring offshore as evidenced by the below graph:

and 2) because of these new discoveries, there is a potential “golden age” of demand for FPSOs as over the next 4-5 years 60 - 66 FPSOs will be tendered, opening up the potential market size of vessels to service for BEZ.

Although the industry is clearly tied to the price of oil, the breakeven prices for drilling offshore, while incurring larger upfront expenses, are a lot lower than onshore breakeven. For instance, in the US Gulf, offshore b/e can be as low as $20/barrel vs onshore breakeven at around $48/barrel or higher. Talos Energy has stated that its offshore projects would remain economical even if global oil prices fall to $35/barrel.

According to Rystad, the cost of developing offshore deepwater fields has halved from $14/boe to $8/boe due to technological advancements (like equipment that can withstand higher sea pressures) and less people needed on board to manage the operations. These new advancements have also opened up more basins that can now be drilled.

Management

The company is run by the CEO Mr. Yong Jiunn Run who has shown that he’s an extremely capable CEO and has developed an impressive track record since joining. There are a couple of good interviews of the CEO out there on the web and in one of them he explains that being a former banker has helped him understand extremely well the benefit of having a strong balance sheet and conserving cash to create a cushion if the industry takes a downturn. This jives well with BEZ’s current net cash balance sheet. Although the CEO isn’t a top 20 shareholder, according to the annual report there is still strong shareholder alignment with the former chairman owning 4.5% of the co. and other insiders and members of the board owning another 16%. The COO is still one of the founders and his son runs the CP division and some of the COO’s brothers sit on the board who are shareholders.

Valuation

In 2025 BEZ sales and profit growth has reversed so far in the first 9 months of the year. Sales are down 11% to $77m, PBT is down 11% to $13.5m and EBITDA is down 8.5% to $16.75m but gross margins INCREASED 200 bps to 37.5%. Because they only own 51% of ASOM, some of these numbers are attributed to minority holders. The reason for the slowdown is due to delayed contract work in it’s African & Guyana operations. Although the work was delayed, it will eventually run through the numbers as it just shifts revenue timing. One thing to highlight that this turnaround is not just momentary in nature is the fact that in 2025 the price of oil has muddled between $60 - $70 and although revenues and profits are down, BEZ has still been able to maintain profitability. 5 or 6 years ago when oil reached these prices the company wasn’t profitable.

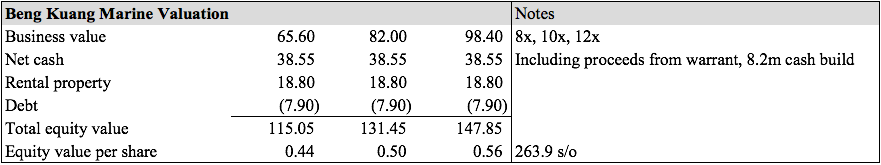

In 2024, after making adjustments for minority payouts and one time gains on sale of assets that went through the income statement, BEZ did about $13.4m in FCF. I don’t expect them to do as well in 2025 but looking out at 2026, any type of recovery in the IE segment could add further to the below numbers. Their CP segment has done/should do $2m-$3m in operating profit or $4m in EBITDA per year and these are recurring in nature. The IE segment did about $30m in EBITDA last year. Even projecting roughly $25m for 2026 for the total segment and a partial recovery, with only 51% of that going to BEZ, comes to $13m. In 2024 corporate overhead for the full year was $7m but so far in 1H 2025 they’ve been able to cut a good amount and annualized I’m projecting $5m. Adding these all up gets to $12m in EBITDA. Subtracting out $1m in capex, $1.8m in corporate tax (17% Singapore rate) and $1m in lease payments leaves you with FCF of $8.2m. An asset lite business with recurring contracts in an industry that has large potential tailwinds deserves a decent multiple and most Singapore comps in this space trade at 8x - 12x earnings (Dyna-Mac, Marco Polo Marine, Mermaid Maritime). Adding the surplus assets of net cash and a rental property they own and subtracting the current debt gives a range of 57% - 100% upside.

If you take the market cap of $74m at the beginning of this post, net out the $38.25m of cash and cash from warrants, add the $7.9m debt (don’t add the NCI because it’s already accounted for when calculating the EBITDA—>FCF) and net out the $19m rental property, true EV is approximately $25m. Right now the market is valuing BEZ at 3x FCF and the free cash flow should grow going forward.

Catalysts

Expansion into other services. BEX recently incorporated a subsidiary that will deal with specializing in industrial chemical cleaning that will be a future growth avenue depending on which segment or geography they wish to start from.

Price of oil goes up. Although offshore has low breakevens worldwide, the larger the gap between breakeven and the price to sell will result in more demand for offshore drilling and thereby BEZ services. The more vessels —> the more demand for servicing.

Intelligent use of excess cash. Management has told me that they are looking at using their cash for working capital and other growth initiatives. I have no problem with that as this team deserves a lot of credit for what they’ve done.

Risks

With BEZ being tied to the oil and gas industry, any further downturn in the price of oil can have a large affect on the future revenues and profitability of the company.

There is always the risk of management doing something unfavourable with the large net cash balance sheet but I think this team deserves a ton of leeway of what they would like to do with it.

More project delays. While project delays shift the revenue to future periods, it is one thing to keep an eye on.