A Left For Dead OTC Stock at Less Than 1x EV/FCF

Summary

Pacific Health Care Organzaiton (PFHO) is a California workers’ compensation cost containment company that:

Trades at 0.26x 2025E EV/EBIT and 0.37x 2025E EV/FCF

In the first 6 months of 2025 they did $618K in EBIT vs an enterprise value of $929K.

No capex is required to run the business and ROIC last year was over 100%

Revenues and margins have recently started inflecting as they’ve expanded into new States

Cash makes up 93% of the market cap with no debt giving strong downside protection

Profitable since 2010

Anytime you’re offered a company at less than 1x FCF with nearly the entire market cap in cash you need to ask yourself:

Why am I so lucky?

In this instance I don’t think it’s hard to find why.

The stock has been left for dead for a number of years on the OTC market

Liquidity is abysmal at 20,000 shares in 3-month ADV, although that’s recently increased.

They’ve grown their cash balance over the past decade without doing much with it

4 large customers have left in the past 10 years

Here’s the capital structure of the company today:

What’s a Cost Containment Business?

Here’s how the business works.

All employers in California, whether it be a small company with 5 employees or the City of Los Angeles with thousands, has a work force of employees. The employer has to obtain workers compensation insurance for their employees BY LAW from either an insurance company, the state insurance fund which is kind of a last resort, they can self-insure if they are a large company or partner with a Professional Employer Organization (PEO). Once an employer decides which one, they can contact PFHO to enroll their employees and use some of PFHO’s services to help reduce their workers compensation expenses if an employee gets hurt.

Here are some of PFHO’s current clients:

A lot of their clients are not-for-profits, municipalities or corporations who typically won’t look to bring what they do in-house. There’s been some insurance clients in the past that have dropped PFHO because they wanted to bring the within their own company.

The business isn’t the greatest with zero switching costs, no real locked in contracts and no product differentiation. But there are certain elements that make it attractive like very little capex or working capital, high returns on invested capital and it’s easy to scale when on-boarding new clients. It’s comparable to a legal or accounting firm. Each year or month you bill the client for your work without having any real contract in place that they’ll come back. If a current customer wants to switch out of using PFHO, sure it’s a bit of a hassle . But if they prefer another company’s service and price they can just notify PFHO that they will be discontinuing their services.

The 5 main ways that PHCO makes money are:

HCO (Health Care Organizations - 20.5% of 2024 revs.)

PFHO offers employers the option to enroll in their HCO’s, which is a state approved managed-care system. PFHO owns 2 of the 3 licenses in California and the other one is held by Promesa Health Inc. An employer might choose to use a HCO because it allows them to control the medical treatment for first the180 days after the initial injury and thereby having some control over the cost. After this time period the employee can look else where outside the organization to help rehabilitate. HCOs differ from MPNs because they are chosen by the California Division of Workers’ Compensation, rather than by employers and their insurance providers.

MPN (Medical Provider Networks - 10.3% of revs.)

PFHO administers 22 of the 2,518 MPN’s issued by California. MPNs are usually a group of either doctors, physios or other medical/healthcare providers that accept a lower billing rate in exchange to get more volume referrals from the insurance company if it joins the MPN. The MPN is used for the life of the workers’ comp. claim. Healthcare providers in an MPN don’t need to have the necessary medical expertise when it comes to treating injuries in the workplace. Customers will choose MPNs because there are fewer costs associated with this program mainly in the form of no annual enrollment fees and less administrative costs and burden vs. enrolling in the HCO. The employer directs which provider the injured employee will see for the first visit and after that the employee can use someone else after within the network if they’d like.

HCO + MPN Hybrid

They also offer a combination of the two if an employer enrolls in the HCO and then just prior to the 180 day expiration, the employer enrolls the employee into the MPN to keep control of the medical care. Medex is the only entity in California that offers this hybrid.

Medical Bill Review (6.8% of 2024 revs.)

Someone from PFHO reviews the medical bills that are invoiced to ensure that bills are reasonable and compliant and nothing nefarious is taking place. PFHO receives a fee for each medical bill that’s reviewed and a percentage of savings off the hospital bill.

Utilization Review (33% of 2024 revs.)

UR is required by law for workers compensation claims. Someone, a nurse or medical director, will compare the treatment plan against the medical guidelines for the injury. It helps avoid potential excessive costs that a medical provider might include.

Medical Case Management (25.7% of 2024 revs.)

Essentially someone that oversees the entire injury process and ensures everything runs smoothly. Each medical case manager (i.e. nurse) coordinates between the employee, medical practioners, claims adjuster, etc to ensure the injured employee returns to work as soon as possible and is on track to healing and closing the claim.

Industry/Competitive Dynamics

The reason the workers cost containment industry exists is because there are potentially two sides of fraud that can occur when dealing with workers’ compensation claims: from the employees on one side and from medical professionals/lawyers on the other. Employees may embellish or lie about their injuries to get more money or not have to work while collecting workers’ compensation. Doctors or lawyers can collude with the worker to exaggerate a claim, over treat or over prescribe. This would cause increased costs for the the claim and the entire system. Just in 2024 alone potential fraud loss that was detected and saved was $157m, so clearly the industry is needed.

Getting industry data for the industry in California has been tricky but here’s what I’ve been able to find:

Two of the largest cost drivers for dealing with workers’ compensation claims are claims frequency and treatment duration.

California has the longest workers comp. claims open after 60 months when compared with other states. More than 3x the states median according to the Workers’ Compensation Insurance Rating Bureau of California (WCIRB) 2025 State of the System. Longer claims open leads to higher costs as you’d expect.

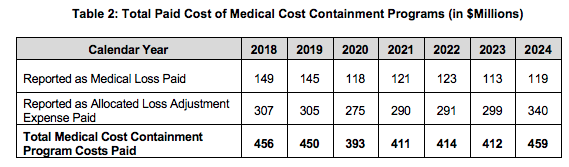

In 2024, insurers collected $15.5B in workers’ comp. premiums earned and paid in total losses and medical expenses $16.7B. Within that $16.7B, $459m went to medical cost containment costs paid and the total cost amount has been pretty stable the past few years. If you want more of a breakdown of these costs you can read it here.

The national occupational injury count in the US according to the BLS for 2023 was 2.37m compared to 2.34m in 2022. In 2023 this resulted in 946,500 cases “days away from work” (DAFW). California recorded 472,500 total recordable cases of nonfatal occupational injuries and illnesses with 297,000 of that being DAFW in 2023. And in 2022 California had 566,000 total cases with 388,600 DAWF.

There is always going to be demand for reducing workers’ compensation expenses as employees continuously get injured and make claims. The problem is that it’s an extremely competitive industry that’s highly fragmented with no real differentiation in my opinion. You can see the number of companies here that have MPN licenses in the state of California. There’s a lot.

Fortunately, you don’t need much to go right here for the stock to work. There’s a price for everything.

Financials

For losing some large customers about a decade ago, their revenues have been pretty stable, hovering between $5m - $7m. You have to go back to 2010 to see the last time they lost money. There is very little capex spent in the business (last year was 0.15% of revenues), and when money is spent on capital expenditures it’s to replace laptops or other devices. There is no building or equipment maintenance that needs to be refreshed.

They convert EBITDA into free cash flow at a high percentage as well. 2024 EBITDA was $886,719. With capex of $9,131, no interest costs and normalizing their tax rate to 28% to include California’s state tax, normalized FCF would have been $629,307. Or about a 71% conversion rate. And because the business is service-oriented and asset light, ROIC excluding cash (EBIT/NWC + PP&E) was over 100%.

Cash has piled up on the balance sheet over the past 10 years. They did a small special dividend and repurchase years ago but nothing really to move the needle. Their most recent special dividend was for $0.10/share in 2023 which shows they do pay SOME excess cash out. They’ve almost mentioned in the 10-K that they’re looking for acquisitions but they haven’t found one yet.

As of Q2 2025 the net cash over total liabilities is even greater at $11.2m compared to $10.36m at the end of the fiscal year.

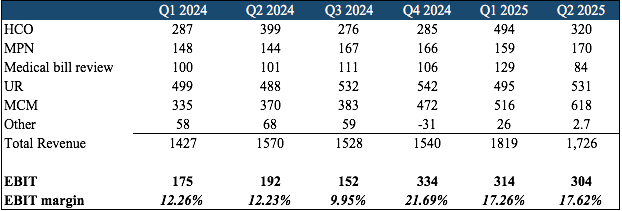

Inflecting Margins & Growth

The company has stated that they are expanding into 6 other states outside of California in their medical case management (MCM) services and the evidence has started to show up. Not only are Q1 2025 and Q2 2025 margins up over 40% to ~17ish% from the prior year quarters, but MCM revenues are up 54% and 67% as well. It is a small base to start from but there is clearly progress being made. The QoQ revenue from the most recent quarter is up 20% too. This business line should be easy to scale and also display operating leverage as it’s just onboarding a case manager who coordinates the entire process for multiple cases.

With the inflecting margins and newfound growth, PFHO just earned in the first 6 months $618,000 in EBIT, or half of it’s enterprise value!

Valuation

It’s tough to find precedent transactions in the space because it’s not that large. MedRisk bought Conduent’s Casualty Claims business in 2024 for $240m. It’s a larger workers comp. claim business with more customers, scale and an auto claims portion attached to it. Conduent didn’t break out revenue or EBIT for their Casualty business in their 2024 10-K as they moved the total revenue line item into “Divestitures” on their income statement and since they sold another business that is included in there for the total $180m revenue, it’s tough to discern the full 2024 revenue that would make up this business.

But if you look at their 2024 Q3 10-Q, the Casualty Claim’s business did $100m in revenue and $6m in pre-tax profit in the first 9 months. Annualizing these for the full 2024 would be $133m revenue and $8m pre-tax profit. Roughly 30x pre-tax. Obviously there should be an increase in margin potential and if we assume 15% EBIT margins (about where PFHO is) the multiple goes to 12x EBIT.

PFHO’s best comparable in the space is the publicly traded CorVel Corporation. Although they are larger, operate in many more states, have more customers and more lines of business than PFHO (auto, general liability, PPO management) some of their business offerings overlap. CorVel is a $4.6B market cap company that has been growing nicely the last few years and returns capital to shareholders through share repurchases. Assuming some decent growth again in 2026, they’re trading at 30x 2026 EV/EBIT and 24x 2026 EV/EBITDA. Clearly trading at multiples significantly greater than PFHO.

Where does that leave PFHO?

Right now if we just annualize what they did in 1H 2025 without taking into account further growth or margin expansion and assuming their net income approximates free cash flow, I have PFHO at 0.26x EV/EBIT and 0.37x EV/EBIT. This is netting out total cash and investments. A ridiculously cheap price.

Clearly if the company was put up for sale they would fetch more than these multiples. How much more is obviously the question. I’ve thought about what would happen if they dividend out their entire treasury portfolio. After the dividend, would the stock really trade down to a few hundred thousand dollars? Or would it be valued more on the underlying business? Your downside is completely protected by the total cash balance right now.

The market isn’t giving them any credit for their huge cash balance or potential for more growth. I use an 8x EBIT multiple to value their core business. It’s a large discount from where CorVel trades at or where Conduent’s segment sold for. It’s an asset lite business with high returns on capital that is growing by expanding into new states. I don’t believe 8x is over the top.

Using 8x EBIT and adding up the estimated net cash at the end of the year, the potential upside is 75% on conservative assumptions.

I mentioned PFHO is comparable to professional accounting or legal firms and these are typically valued based on billings or projected billings between 1x - 1.5x. Even if you valued PFHO that way the value of the core business would be roughly the same.

Management/Shareholders

The CEO, Tom Kubota, is 85 and has been the head of the company for 25 years. He has an ownership stake of 65% but effectively controls near 100% of the company due to some preferred voting shares. He hired a bank to help explore M&A a few years back but nothing has come to fruition yet. As I said above he’s attempted a little capital allocation with the special dividend in 2023. His salary is nothing egregious for the size of the company at $200K.

One interesting thing to note is that both of his daughters had been working for the company and sat on the Board of Directors for the past decade up until recently. Kristina, one of the daughters, was the CFO from 2021 to 2024 and just resigned from the Board this month. Lauren, the other daughter, had been with PFHO for 10 years and in the same 8-K filing as Kristina’s resignation also resigned from the board and her position as Secretary of the company. Both left to pursue other professional endeavors. At age 85 and no family members in the business, it would be an opportune time for Tom to get his estate in order and possibly sell the business.

The daughters’ board seats were replaced with Bruce Everakes, who owns a 5.5% stake, and Scott Allen, who is the company’s controller. Their legal counsel, Donald Balzano, owns 6.9% of the company as well so there is huge insider alignment.

Catalysts

Something finally happens with the cash. Special dividend? Acquisition? Buyback? The company doesn’t need a lot of working capital to operate and the entire treasury portfolio should be sold and paid as a special dividend to shareholders which would be $0.76 cents a share. Almost the total share price.

Potential sale of business. The CEO is 85 years old and both daughters just exited the business. If there was ever a good time to cement a legacy, it should be within the next year or two to sell.

Continued expansion. Growth by expanding into other States as they have been doing.

Multiple expansion. Underlying business gets some type of multiple put on it. It used to trade at a higher multiple a decade ago when it was growing but since then it’s suffered multiple compression. The recent growth might get rewarded with any kind of multiple.

Acquisition. The company finally makes an acquisition.

Risks

Customer concentration. They have 3 customers that make up 43% of sales and in the past they have had large customers leave with Walmart being the most recent. However, most of these customers left because they either brought the business back in-house as a result of being insurers themselves or just stopped using certain services PHCO provides all together. Most of the current customers represent corporations, non-for-profits or cities that are unlikely to bring what PFHO does internally. Even losing customers over time they have still remained profitable. But there is a risk that you wake up one morning and lose a large customer.

Business Quality. The business competes on price and quality. I don’t believe there is a real “moat” but they’ve been profitable for a long time even when they lost large customers. If someone offers a better price or service, they may lose the customer. Depending on the size of the client and number of employees, it could be a bit annoying to move everyone over to a new provider.

Majority shareholder risk. The CEO owns 65.7% of the common stock but essentially 100% of the voting control of the company through the preferred. There are 16K preferred that are convertible on 1-1 basis of the common but each share of the preferred has 20K/share of votes. While not a risk “per se”, he has total control of the outcome here.

The outcome I’d like to see is the for the treasury portfolio to be sold off an dividend off to shareholders. Followed by a sale of the business. It’s a fragmented market and I am sure there would be many bidders for this. WIll it happen? Who knows. Your downside is protected with the huge cash + investment portfolio and you have upside in the event some type of multiple is placed on the underlying inflecting business.

Disclosure: Long PFHO