Case Study: Warwick Valley Telephone Company

I came across this article from 2006 about Larry Goldstein (of Santa Monica Partners, or SMP) and his investment in Warwick Valley Telephone. I made some notes that I thought I’d share in the form of a case study at what made Warwick an interesting set up but ultimately not a successful investment. I like reading old writeups or articles to see what information was available at the time of an investment to see what the investor was seeing and think if I would have made the investment as well. It’s also a good way to screen for future investments based on the setups of the past and certain pattern recognition to look for.

I believe SMP owned this a few years prior to filing their first 13D but I’ll start with when the first 13D was filed at the end of 2003. From what I read the total size of the position for SMP was 1.7% (based on $160m fund size and $2.65m investment). Not huge, but I think he set a record for the number of 13D letters sent to a company.

Valuation

Warwick was a rural local exchange carrier (RLEC) in a few small towns in New York and New Jersey that was muddling along with a few million in profits. The stock had been owned by families in the Goshen, New York area and passed down generation to generation. Apparently the largest shareholder was an elderly lady who lived in Warwick too.

At first glance it doesn’t seem that appealing. On the surface it appeared expensive and more than fairly valued.

Equity Income > Operating Income

But if you look closely at the financials you’ll see they generated more money from their equity investments than their main RLEC business.

Flipping to the balance sheet, those equity investments that generated $8.3m in 2003 were carried at only $5.3m.

And going to the back of the annual report to Note 9, you’d see a breakdown of what these investments were.

The O-P Partnership was a 7.5% joint venture in a Limited Partnership called Orange County-Poughkeepsie Limited Partnership (“OCP”) with Verizon that sold wireless minutes to larger telecoms that was hidden from the consolidated financials. Verizon owned a majority 85% of the partnership as a GP. How did a partnership investment carried at $3.7m throw off so much equity income?

Well when you read the disclosure of how the partnership was doing, this was what you would have seen:

For a better visualization, this would be the past few 5 years (excluding 04 and 05 at the time).

The partnership owned what seemed like one of the best businesses in the world: fast growth, huge margins and it barely needed any capital to operate or grow. Because the investment was accounted for using the equity method, you couldn’t see the valuable partnership investment unless you looked in the notes. Yes you could see some income from equity method affiliates, but you had to dig a bit further to grasp exactly what you were looking at. Anyone running a screen back then probably wouldn’t have picked up on this.

The OCP partnership even paid out the vast majority of their income to partners. The millions that were distributed to Warwick were essentially propping up the muddling RLEC business.

So they had an investment on the balance sheet marked at $3.7m that was likely worth many multiples of that and paying out millions of distributions. Yet SMP didn’t think it was being fully reflected in the stock price.

SMP First 13D

Santa Monica Partners filed their first 13D (the first of many) in late 2003 when the share price was $25.5 vs where they thought it should be at $39. They gave a list of 5 unique options that Warwick could do to highlight the underlying partnership value:

Here’s the full 13D filing. My favourite financial engineering option here is #1 because it’s pretty unique. I don’t think I’ve ever seen a company do that. Issuing a debt instrument backed by the distributions of the partnership stake to create over $100m in value.

The management team didn’t seem to think it was worth that much though as they had a valuation done the prior year. Their advisors only came up with $22.5m.

However, it would be the spinoff that SMP would argue for as detailed in a follow-up letter. By doing the spinoff, the new company would get the original Warwick RLEC business and the existing company would keep all the investments so it could pay out all of it’s income as dividends.

Management and the board refused to engage with SMP and discuss any of their ideas. They continued taking the partnership distributions and plowing them back into the RLEC, which continued it’s decline.

With an unwilling board SMP tried a different tactic.

Verizon Ploy

Remember Verizon owned 85% of the partnership. At the time, Verizon had $53B in debt and was looking at selling assets to pay some of that down. So SMP sent a letter to Verizon’s CEO outlining what they thought OCP could fetch in an IPO.

Based on their estimate, on the high end it could go for $3.8 billion and on the low end $1.5 billion. Verizon’s 75% proceeds would be $1.8B - $3.26 billion. SMP even asked for an investment banking finders fee if they proceeded with their plan.

I’m not sure if they did or didn’t hear back from Verizon but I’m going to say not because nothing came of the letter. Verizon continued owning their 85% of OCP.

With this tactic not working, SMP tried another one.

Letter to Shareholders

A year passes and in May 2005 the shares are now down to $21.

With still no real response from Warwick’s management or board, SMP obtained the shareholder registry and decided to write what they thought the stock was worth to all the shareholders.

They believed Warwick’s 7.5% ownership stake in the OCP partnership was worth $28.5/share - $40/share.

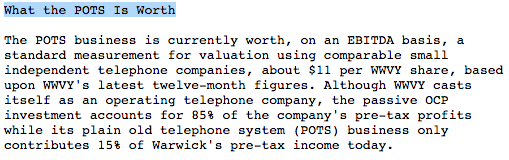

And the RLEC business was worth another $11/share.

This was about 100% upside from where it was trading. And STILL management refused to engage as their stock had fallen the past couple of years. The value was clearly there waiting to be unlocked but management kept putting the distributions from the fast growing wireless partnership into the declining RLEC business. Not doing anything to increase the value of the company’s stock.

There were then numerous 13D’s filed by SMP trying to embarrass the board and management. From failing to budget for Sarbanes-Oxley costs to incessant questions about how the business was going to be run for shareholders. None if it working to get management to do what they wanted

SMP tried another tactic now.

Investment Company Act

It’s now December 2005 and the stock sits at $19.

The SEC just sued National Presto for not registering as an Investment Company and won during this time because they had investment securities that represented 61% - 92% of their total assets.

National Presto now couldn’t engage in any interstate commerce or sell any securities until they registered as an Investment Company. And there could have been personal liability had the executives continued to defy the law as they were currently evading regulations when not registered properly.

I’m not an Investment Company Act expert, but from my understanding the two big tests of being an Investment Company under the Investment Company Act are:

At least 40% of the company’s assets are in securities or investments

More than 90% of the overall income is derived from the investments

Because OCP’s fair value was much greater than the value of the original RLEC business and the fact that pretty much all the pre-tax income of the entire business was generated from this investment, Warwick was potentially an Investment Company.

They even disclosed as much in their 10-K stating they might have to register and restructure as an Investment Company. It starts to make a bit more sense now why Warwick’s advisors only valued the OCP at $22.5m vs $91m for the main operating business. So they wouldn’t have to restructure.

SMP picked up on this and in 2005 filed a proxy wanting either a spin, sale, or to register Warwick as an investment company. By registering as an investment company, Warwick would have to restructure into two different companies and the investment company that’s holding the limited partnership would operate as a pass-through entity and pay out all of it’s income. This would be a huge win for SMP as they had been angling for a huge dividend increase as well.

You can apply for relief under Section 3(b)(2) of the Investment Company Act to the SEC and state you aren’t an IC but the SEC doesn’t have to necessarily grant you that relief. Warwick applied for relief and withdrew their application before the SEC even ruled.

Again, nothing ended up happening with this tactic as the SEC never made them register and SMP couldn’t get them to register themselves.

Proxy Fight

It’s April 2006 and the stock has drifted lower still to around $18. SMP finally decides to file a proxy and nominate themselves to the board as well as increase the dividend substantially. They faced an uphill battle as many shareholders were local and didn’t seem to want any change.

The partnership investment still kept growing for the most part as you can see below. But the main RLEC business was now burning cash and decreasing in value each year that passed along.

Even with the stock down more than 30% since the first 13D was filed, the other shareholders still chose to not vote for SMP’s proposals.

The Following Years

The stock continued to drift lower over time. In November 2009 it sat at $12.68 and this was the last 13D filed by SMP. They introduced a potential buyer to the company but management didn’t want to sell. Kind of unbelievable.

In 2011, Warwick purchased Alteva and changed its name.

And in 2015 it was finally bought out for $28.7m. I’m not sure if SMP still owned shares or not but it was a far cry from what they thought it should have been worth 10 years prior.

What Went Wrong

This seemed like the ideal Good Co./Bad Co. An extraordinary business that was hidden in the financial statements of a slowly dying business. There were a few problems that made this a poor investment:

Poor capital allocation - The value was clearly there, but the growing cash flows from the partnership were being reinvested into the slowly declining RLEC business. They were throwing great money after bad.

Staggered board - Only 3 directors were allowed to be elected each year. It would take a few years to at least control the board and exert some type of control.

Disengaged management and board - Because SMP only owned 2.5%, the executives and board didn’t really have to do anything they said because they didn’t control or have that large of a position. They had no urgency to increase shareholder value as they didn’t own much stock and didn’t feel threatened about potential executive turnover.

Lack of other shareholder pressure - You would think with a declining stock price that other investors would hold management accountable. But other shareholders weren’t fans of SMP and decided to vote against SMP’s ideas.

Knowing what happened after the fact, it’s easy to think I’d pass on making this investment. I’m almost certain I would’ve jumped at the chance to own such a unique asset that seemed undervalued in the market. That’s what makes investing so tough. The set up from a valuation and business stand point was extremely compelling but the capital allocation/management angle wasn’t. You typically need both to make for a great investment.

SMP summarized what happened here perfectly: