57 out of 12,333: An OTC Journey; A Couple of Names

I recently spent some time combing through the OTC market. It’s a pretty daunting place to look for stocks. Not only is information scarce but the sheer number of companies is overwhelming. Not a lot of investment funds can invest on the OTC exchange and the SEC made the purchase of Expert Market stocks extremely prohibitive a few years ago where only a select few brokers can even transact in the names.

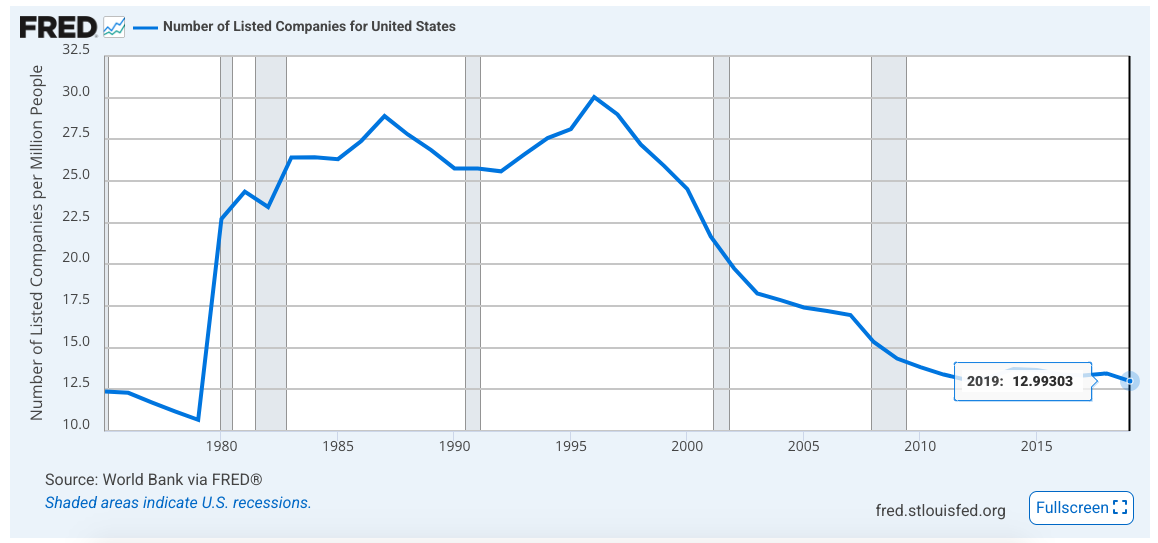

According to data from FRED, there are approximately 13,000 listed securities in the US, down from 30,000 in the 90’s. However, I’m not sure how accurate that number is.

Research Process

When I went to to the OTC website and clicked stock screener there were about 12,366 OTC securities. A huge number of potential investments but they also include a lot of international listed stocks.

While you do have the option of running a screen, some OTC companies don’t release financials so some of the companies won’t even be on there. Also, I never know if a screen will pick up every security so I don’t usually trust them as the ones that fly under the radar are usually the interesting ones. One thing I noticed is that the securities on the OTC page don’t list any “expert market” stocks (one of the tiers on the OTC). For that I had to go to FINRA and download another set of securities that had 50 listings per page and the document was 619 pages. That’s a lot of securities.

So now I had all the 12,366 OTC securities without the expert market stocks and all 31,000 securities which included the Nasdaq (2,800 companies), NYSE (4,205 companies) the OTC (12,000) and in the remainder spread throughout were the expert and grey market securities.

The problem was I now had two huge data sets with a ton of stock overlap on both sets. Sifting each OTC listing, while trying not to miss an expert market stock, I’d have to comb each set of data and compare page by page, line by line and look for a company that isn’t included on the OTC initial data set. It was a pretty annoying process and I’m sure there must be an easier way so if anyone reading this has a better way, I’m all ears.

Once I figured out the listing of the securities, I went through each one. A lot of them got an easy pass within the first 30 seconds once I saw the financial statements.

No revenues, lots of share issuances, liabilities > assets, unprofitable, poor quality business or just no real business at all. The international stocks I didn’t bother going through as I’ll look at those companies when I get to their exchange.

There were a TON of small banks that were all roughly fairly valued at 10x earnings and 1x book value.

It wasn’t all bad though. In there were some unique, profitable businesses with strong balance sheets that for whatever reason choose to remain listed OTC. These companies made it past the first 30 seconds and I would usually read their annual report and add them to my watchlist.

By my count, I added 57 companies that I can put on my watchlist out of a possible 12,333.

57 / 12,333 = 0.46%

While some of that 57 includes some expert market listings and some in that 12,333 doesn’t include the expert market listings, you get the picture. The percentage of finding something interesting is very low compared to the number of companies thrown at you. It’s a numbers game.

One of my favourites in terms of whacky stocks that I came across was the Rochester Community Baseball Inc. which is a AAA minor league baseball team that trades on the expert market. I’m not even sure you can buy it to be honest. The team is an affiliate of the Washington Nationals of the MLB and there was a good article a few years ago outlining their revenue sources which totalled over $10m. I thought about trying to ask around for some financials or shareholders and buying a stake as I don’t live very far from there, but I don’t think I’d be able to turn them into the next Savannah Bananas.

I also found:

An over 100 year old news paper company that has a market cap of $10m with about $3.3m in net cash, $3.6m of PP&E measured at historical cost that just did $1m in profit in 2025.

An educational company with a fast growing digital segment that pays out large dividends with 58% of its market cap in cash trading at 6x-7x free cash flow

A bank that just underwent a mutual conversion trading at roughly 50% of book.

2 Quick OTC Pitches

Q.E.P. Co. (QEPC)

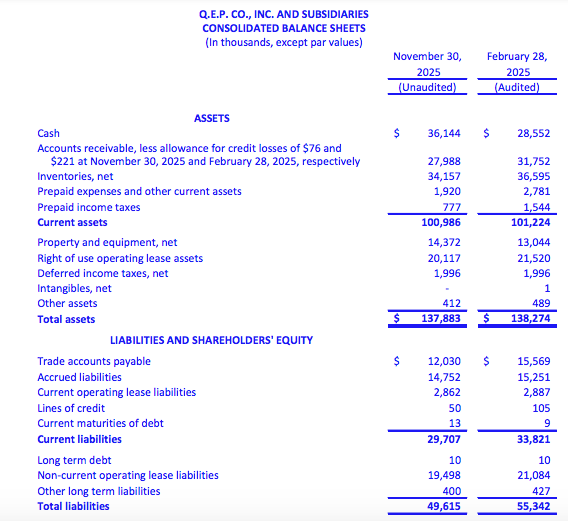

QEPC is a $130m market cap company that manufacturers tools and other accessories for the home improvement industry that are sold in home improvement retail locations (Home Depot for instance). In 2023 the founder, Lewis Gould, appointed his son, Leonard Gould, as CEO. Once appointed, Leonard got to work real quick. Although QEPC started selling some assets prior to Leonard’s hire, the new CEO took the divesting of assets into overdrive. QEPC sold a bunch of international operations which increased margins and the proceeds from the asset sales were used to pay down debt. Today the company has a relatively stable business with $36m in net cash for an enterprise value of $94m.

The divestments have shrunk the overall business but has turned it into a more profitable operation. I have the company doing about $20m in EBITDA for the year that’s about to end which puts it at 5x EV/EBITDA. Pretty cheap compared to peers at double or more the multiple.

The founder owns 50% of shares outstanding and liquidity is extremely low. Shares trade a few hundred a day and you’re lucky if a couple of thousand shares trade. With an 82 year old shareholder, these past couple years of “cleaning up the business” could be to position the company in the best financial light if they were to sell. The company would make a nice tuck-in to a larger competitor as most, if not all, of the executive positions could potentially be eliminated as 3 of the top executives make a combined $4.5m.

Westell Technologies, Inc. (WSTL)

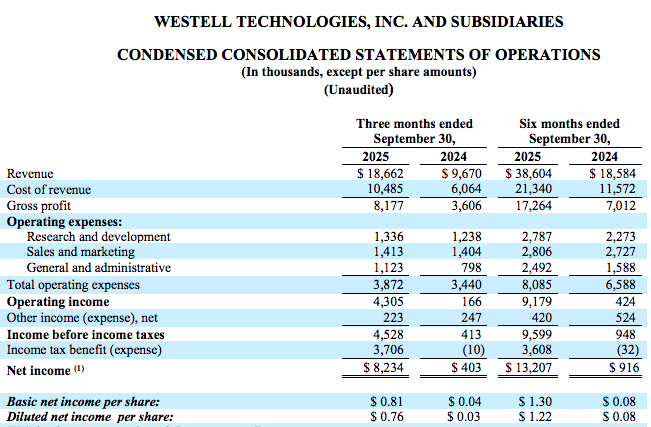

WSTL is another family controlled company that has also undergone a bit of a turnaround due to a change in management in 2019. The current CEO came in and has reduced the share count since by 31% (15.7m to 10.9m) and restored the company to profitability.

WSTL has a market cap of $66m and operates 3 segments:

In-Building Wireless (IBW) that provides DAS solutions to facilities that help first responders communicate in emergency situations.

Communication Network Solutions (CNS) sells outdoor network enclosures, fuse panels and other boxes and panels that serve the telecommunication and utility industry.

Intelligent Site Management (ISM) offers remote units that allow cell tower operators/utilities/etc. and others the ability to monitor their site remotely and therefore save on trips to the site if something is down or take preventative action to make sure everything is working as it should.

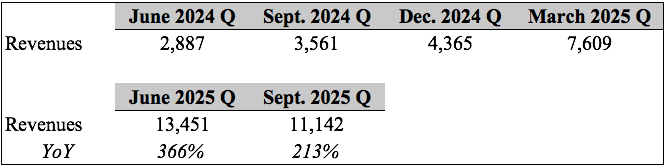

It’s really the ISM segment that makes this extremely interesting. In early 2024, the ISM segment started to grow extremely quick.

This has led to an explosion in earnings. In the first 6 months of their current fiscal year, they’ve earned $13.2m in profits when you give them credit for the release of a $3.8m valuation allowance compared to $916K in the first 6 months last year.. Taking this tax item out, it’s still $9.6m. Up 10x compared to the prior years first 6 months.

The balance sheet is extremely strong with no debt and $26.4m cash position which gives an enterprise value of $39.6m. There is roughly $20m in NOLs that can still be used up should the company continue its strong profitability and based off of the March 2025 backlog of $25m in just the ISM segment, seems like it should continue even though that number might stale. While it’s incredibly difficult to value a company that is growing quickly, using the numbers they just put up it trades at 2x -3x EV/EBIT, less than 3x earnings and 1.2x book without bringing the remaining NOLs on to the balance sheet.

What’s driving the growth in the segment? I don’t have a great answer to that as there are very little disclosures put out by management which is why it trades where it does and also why it is a smaller position for me. I’ve heard it could be from an increase in data centre monitoring to the BEAD program signed into law a couple years ago. Until I get a bit better understanding of 1) why the business has inflected and 2) if that growth is sustainable or not, it’s a smaller position for now.